- Products

- +

- -

- Starburst vs OSS Trino

- Open Data Lakehouse

- Data Mesh

- Artificial Intelligence

- ELT Data Processing

- Data Applications

- Data Migrations

- Data Products

- Customers

- +

- -

- Learn

- +

- -

- Partners

- +

- -

- About

- +

- -

- Login

- Start Free

Starburst Galaxy

Fully managed in the cloud

Starburst Enterprise

Self-managed anywhere

By Use Cases

By Industry

Documentation

Connect

Education

×

Filter:

Blog

Resources

Pages

Documentation

×

Filter:

Blog

Resources

Pages

Documentation

Global Investment Bank

Fighting financial crime with real-time analytics

One of the world’s leading investment banking and financial services companies accelerates money laundering detection and prevention by retrieving data of suspicious activity instantaneously through Starburst’s query engine.

Billions

of dollars of potential fraud prevented

Millions

of dollars saved in averted fines

100+

countries have instant access to analytics

Region

Americas

Industry

Financial Services & Insurance

Environment

Hadoop

Solution

Enterprise

Employees

1000+

I’ve talked to a lot of vendors over the last 18 years, and nothing came close to what Starburst can do. This is something we had been looking for some time, and I’m very happy that we found Starburst.

Anonymous

Head of AML Technology

Billions

of dollars of potential fraud prevented

Millions

of dollars saved in averted fines

100+

countries have instant access to analytics

About

As one of the largest banking and financial services corporations in the world, this company’s mission is to make its client’s lives better with modern financial solutions to contribute to a growing economy. The multinational investment bank serves millions of people and institutions in over 100 countries.

An estimated $800 billion to $2 trillion U.S. dollars is laundered globally every year. If undetected, banks are subjected to heavy fines in the millions – and sometimes billions – of dollars. Anti-money laundering (AML) policies have become a critical component of this financial institution, and require petabytes of data stored in multiple warehouses across the world.

Challenge

This investment bank monitors hundreds of millions of transactions each day for suspicious activity and stores those transactions where the AML department can easily access them. With this setup, the investment bank faced the following challenges:

- An enormous amount of data resided in multiple warehouses around the world, making it difficult, costly, and time-consuming to access.

- This wide range of data for products and services along with differing data sovereignty regulations for each country presented a barrier to monitoring illegal activity — making it difficult to identify a bad actor or institution.

- Complex regulatory environments for banks and lengthy investigations made it imperative to find a way to achieve near real-time analytics.

These challenges prevented the bank from meeting the time-based demands required by government regulators such as the Office of the Comptroller of the Currency (OCC).

Solution

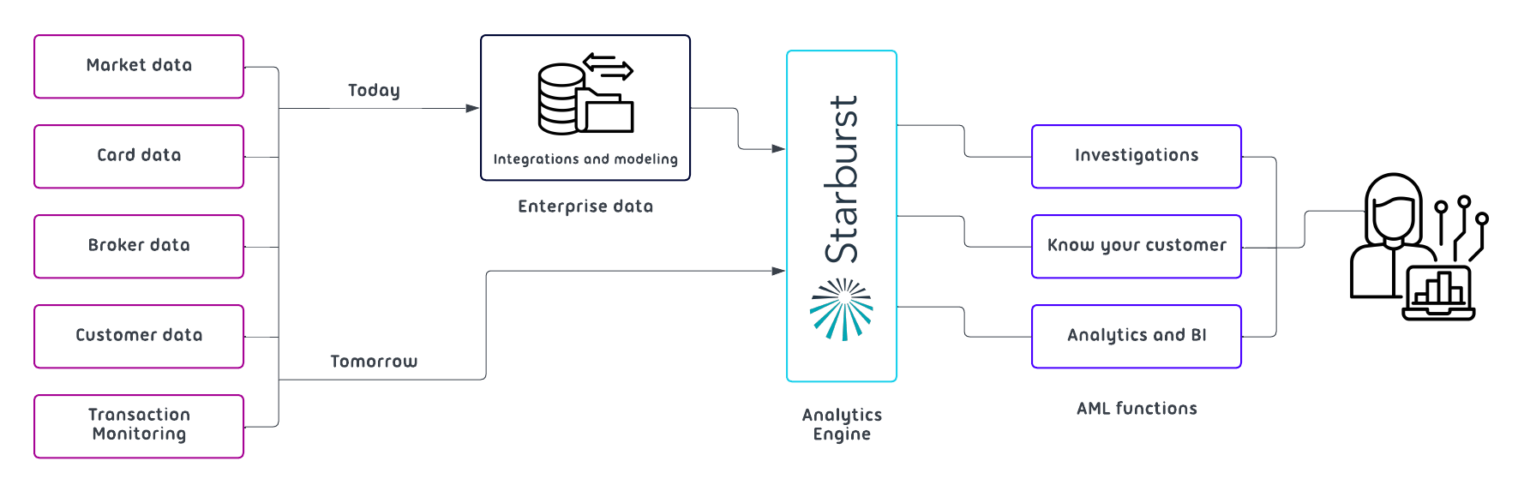

As the bank started to build out its data lake as part of its data mesh journey, it wanted to modernize its Hadoop stack, in particular its Apache Hive query engine. By deploying Starburst, the bank can access data from anywhere, without needing to duplicate or move it.

Not only does Starburst Enterprise solve the challenges around timely access to data, but it also solves the problem of data access from countries with strict data sovereignty rules. The bank is not storing data outside of its country of origin or reading any personal information, so many of its challenges no longer exist.

The bank also has enhanced money laundering detection models. Each time a new financial product is created, the team identifies the AML risks associated with the product and creates a machine learning model to prevent and detect illegal transactions. Starburst allows data scientists to rapidly test new AML models, update existing models, and profile new data.

In addition, with government regulations for AML constantly evolving with modern money laundering trends, Starburst’s federated computational governance ensures continual compliance and data security.

Results

After deploying Starburst Enterprise, the multinational bank has gained some major improvements in accuracy and efficiency.

Improved detection of money laundering. The improved models increase the efficiency of the alert investigation process while reducing the number of false positives.

Timely and actionable insights. With Starburst, the investigations team can access AML data in near real-time and across multiple data sources, without having to ask the monitoring team to copy and send extracts of information from multiple physical warehouses.

Fewer penalties. Access to big data and big data analytics helps the financial institution better monitor transactions and address fraud more effectively. This reduces the risk of fraud and subsequently reduces the risk of penalties for AML violations and regulatory fines, saving money in the long run.

Ongoing model training and development. In the future, the machine learning models will access all historical and current data sets to constantly train and improve the model in real time.

Cost savings. More timely and actionable insights, reduced data duplication, and quicker time-to-insight results in cost savings for the multinational bank. The cost of investigations is also lowered by putting more complete data in the hands of investigators, which reduces the rate of false positives.

Overall, Starburst Enterprise has enabled real-time analytics on a massive scale to meet the growing threat of financial fraud. Faster query performance, seamless federated queries, and rapid access to new datasets all contribute to shorter AML investigations.

Region

Americas

Industry

Financial Services & Insurance

Environment

Hadoop

Solution

Enterprise

Employees

1000+

A single point of access to all your data

Stay in the know - Sign up for our newsletter!

Quick Links

Get In Touch

© Starburst Data, Inc. Starburst and Starburst Data are registered trademarks of Starburst Data, Inc. All rights reserved. Presto®, the Presto logo, Delta Lake, and the Delta Lake logo are trademarks of LF Projects, LLC

Start Free with

Starburst Galaxy

Up to $500 in usage credits included

- Query your data lake fast with Starburst's best-in-class MPP SQL query engine

- Get up and running in less than 5 minutes

- Easily deploy clusters in AWS, Azure and Google Cloud